The Vitality Index

Mobility data and the foot-traffic patterns of cities

2020-2022 Findings

Measuring the movement of people and places

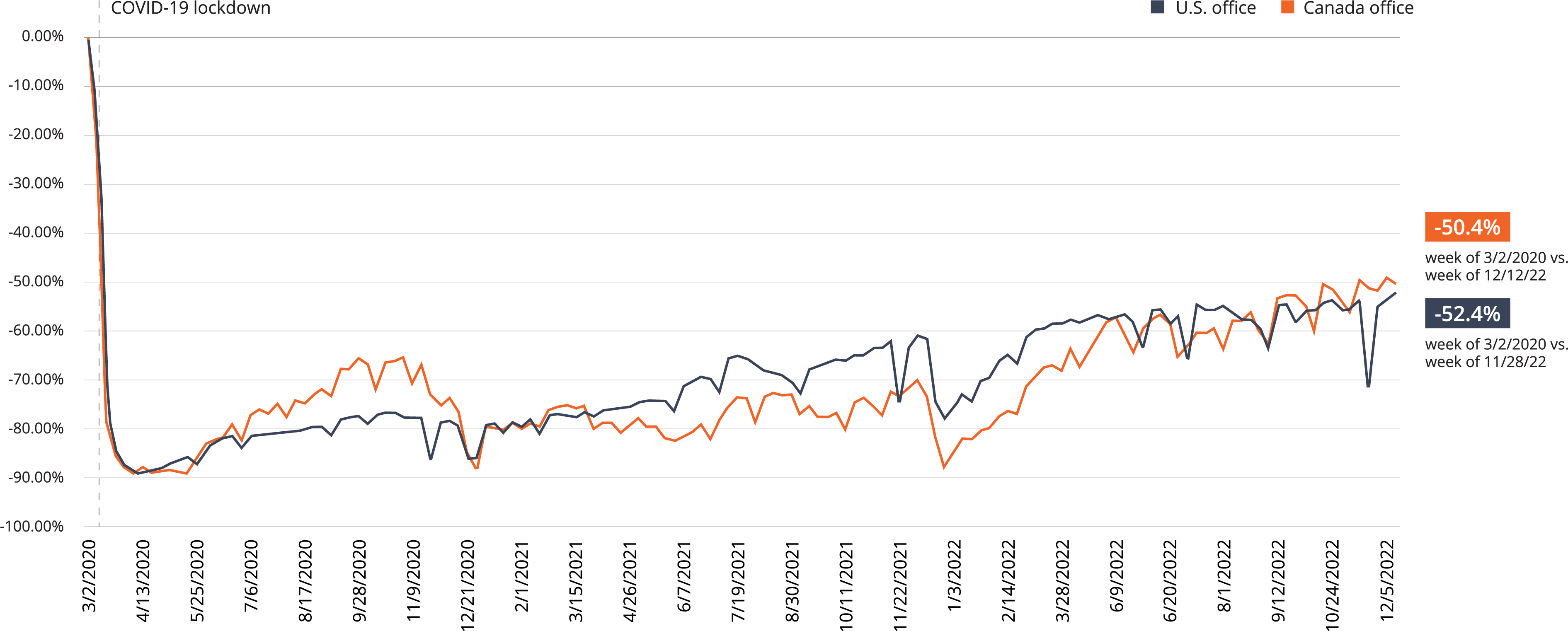

Avison Young’s Vitality Index is a dynamic dashboard of weekly foot traffic patterns from 52 markets across North America – offering holistic, big-picture views of the vibrancy of our cities across markets and sectors.

The tool allows you to compare a wide range of unique data sets against one another – week over week, market against market, sector against sector, to find the critical trends commercial real estate owners, operators and investors need to know to make their most impactful decisions yet.

Innovation and Insight Advisory, U.S.

Here’s just a snapshot of what our Vitality Index data and reporting taught us in 2022:

- City vitality is benefiting from a surge in leisure activities such as visits to cultural and sporting events, restaurants, and other social activities.

- For businesses that depend on worker foot traffic, understanding traffic patterns can help determine optimal opening times and staffing needs, and offices can leverage these same insights toward critical decisions around energy consumption and space planning.

- People are making changes about where they go when, prioritizing places that fit their unique needs now. This has led to increased numbers of traffic to the suburbs during the week, and downtown traffic spikes on the weekends, which were often reversed in the past, among other new and emerging trends.

- Retailers can solve for locational strategies leveraging total visitor volumes and days of the week data creatively paired to customer experience aimed at capitalizing on or creating a rise in foot traffic numbers.

- Culture and experience seem to be driving decisions for consumers across all markets and sectors.

Where the numbers will take us in 2023

This year, we will be launching new reports and case stories shaped by the latest U.S. and Canadian-based insights found in the Vitality Index – with new, improved, and expanded data sets. Sign up now, so you don’t miss out.

Sign up to be notified when these new Vitality Index reports are shared

Custom insights are ready for you now

While broad analysis and official reporting is on the way, we can dive into specific questions and criteria most relevant to your business at any time.

Get in touch, and let’s build a custom dashboard together, shaped by your unique needs and goals for 2023 and beyond.

Contact the team

Thomas Forr

-

- Director, Data, Analytics & Innovation, Canada

-

- Consulting & Advisory

- Corporate Executive

- Market Intelligence

Get in touch

Please leave your details and an advisor will contact you.