Distressed assets? Not yet…

February 16, 2021

February 16, 2021

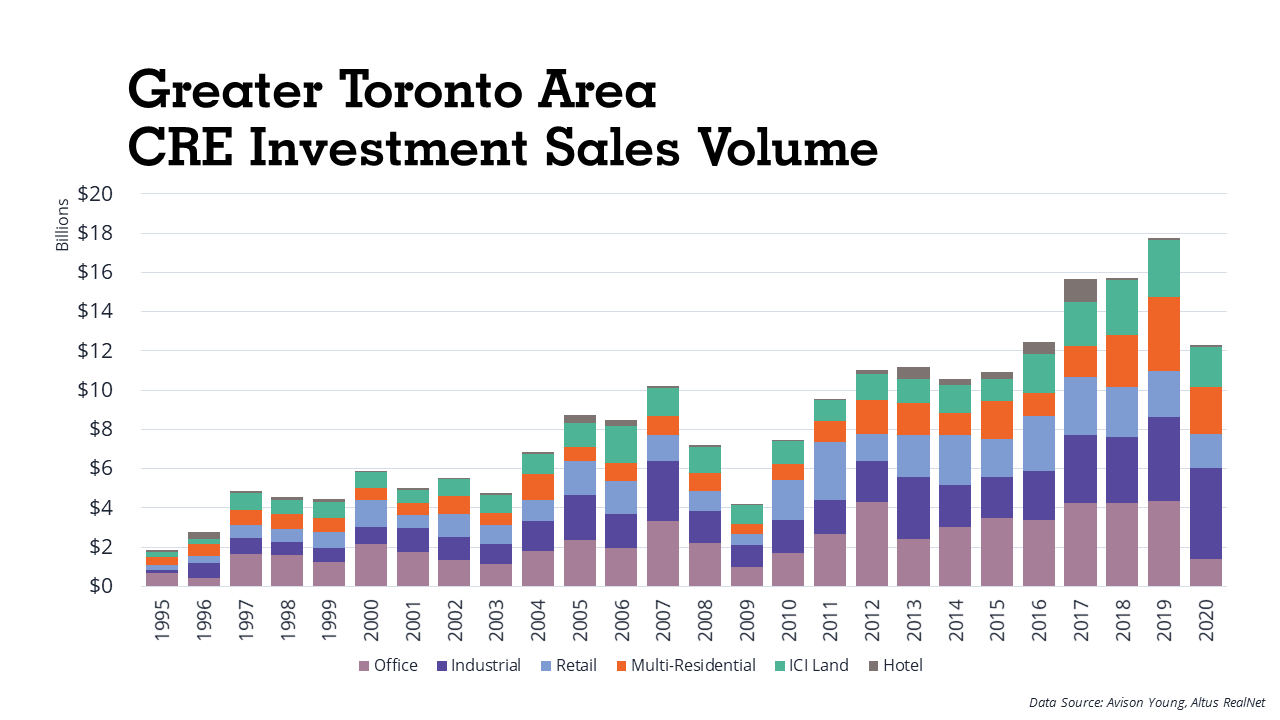

In the Greater Toronto Area (GTA) commercial real estate (CRE) market, the predictable fourth-quarter surge in investment sales was a welcomed respite in a year where the unpredictability of the pandemic stymied investor appetite for select properties – bringing several years of record-high investment sales results to a halt.

Across the GTA, $12.3 billion in office, industrial, retail, multi-residential, hotel and ICI land assets (>=$1 million) sold in 2020 – down 31% year-over-year. Investment declined in every sector except industrial. However, the foundation for a return to past and even better performances – low borrowing costs and plenty of capital – remains intact and the wide distribution of vaccines should help sustain investor demand in 2021. (More details are available in our Fourth Quarter 2020 GTA CRE Investment Review).

A widening bid-ask gap has emerged as pricing has largely held firm for some assets despite fewer bidders and expectations of a “COVID discount”. This has slowed deal velocity, further constraining transaction volumes, resulting in questionable asset valuations.

Major economic downturns have a habit of bringing about change and opportunity in the CRE sector. Add into the mix a protracted pandemic and investors are presented with an unprecedented set of circumstances. One type of property that savvy and opportunistic investors have set their sights on: distressed assets.

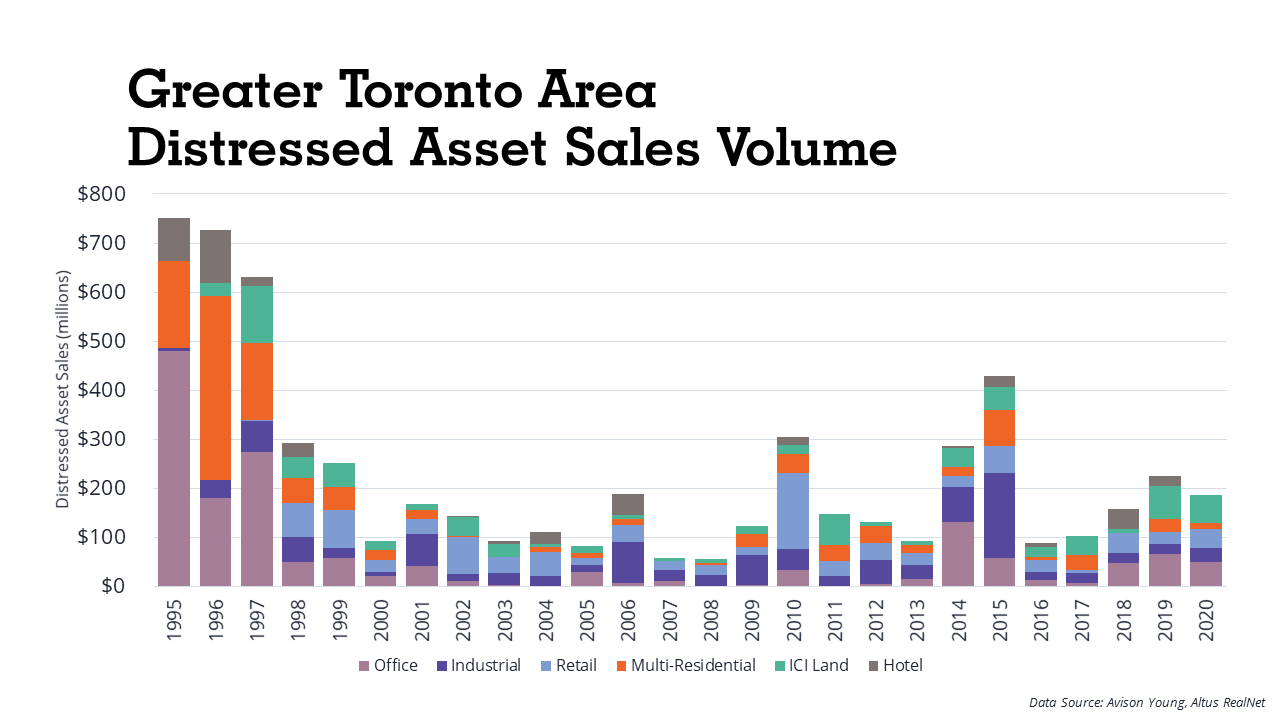

A look back at distressed-asset sales in the GTA’s CRE sector since 1995 provides some perspective. Some interesting highlights include:

- The market posted very high volumes of distressed asset sales in 1995 to 1997 – the lingering effects of the economic downturn of the early 1990s. Even without adjusting for inflation, these levels have not been recorded at any time since.

- A decade of generally declining volumes – with little impact from the dot-com crash at the turn of the century – followed from 1998 until 2008, when the volume of distressed assets changing hands was the lowest in this 25-year period.

- Once the impacts of the 2008 financial crisis started to take hold, annual volumes rose rapidly as distress sales lag behind the crisis that caused them. In 2009 and 2010, a total of $428 million in distressed assets changed hands – representing a mere 4% of total dollar volume.

- Of that $428-million two-year total, the retail sector posted the highest cumulative distressed asset sales volume (40% of total), followed by industrial (24%) and multi-residential (15%).

- The effects of this crisis continued to be felt at least through 2015, when volume reached a recent peak of $430 million – and in fact, volume has never returned to pre-crisis levels, with the lowest total since 2009 posted in 2016.

- The GTA market posted only 26 distressed-asset sales totaling $185 million in 2020, down from 29 totaling $204 million in 2019. By dollar volume, the ICI land sector accounted for the largest share of the 2020 total (30%), followed by office (27%) and retail assets (21%).

There’s no doubt the current crisis has taken its toll. Apart from industrial assets, the pandemic has impacted valuations across the CRE spectrum, most notably in the hotel and retail sectors, and to a lesser degree in office and multi-residential. Surprisingly, a year into the pandemic, overall transaction volume remains low and given weaker valuations and stress in some property types, the GTA CRE market has yet to see a meaningful volume of distressed asset sales. I suppose that’s a good thing for now.

At the best of times, investment capital hates uncertainty and this has kept many investors pretty much on the sidelines, while owners and borrowers are avoiding the inevitable fire sale. It’s a testament to the market’s largely institutional ownership base and relatively sound (though stressed) property market fundamentals.

Meanwhile, there is a heightened level of scrutiny during the due diligence process with many lenders less willing to engage in higher-risk investments. Unlike in previous economic downturns, there is a barrage of government financial aid and support programs aimed at helping businesses and CRE operators get through the crisis – and perhaps this is also keeping distressed-asset opportunities at bay. However, if new virus variants or other factors continue to prolong the pandemic, further impacting property valuations, some owners may eventually be left with few options to cope with ongoing income loss.

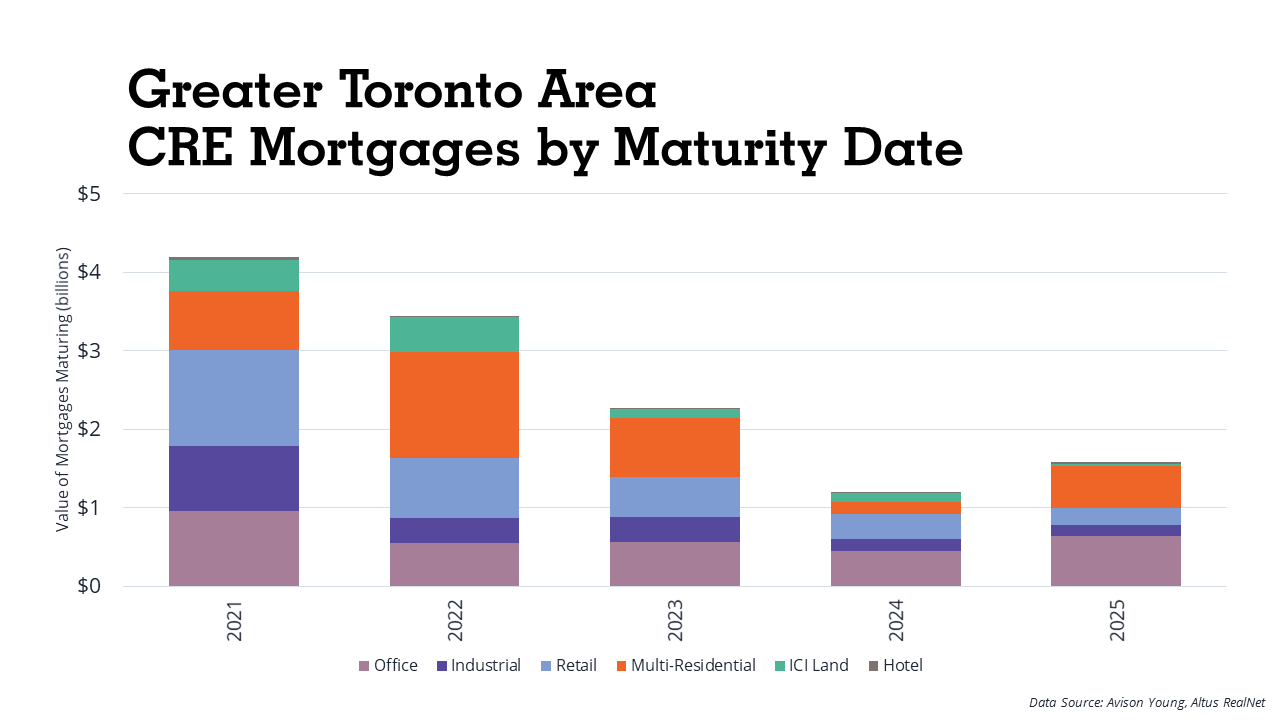

What does the future hold? The chart above gives an indication of the value of mortgages maturing in each of the next few years, based on a sample of available data for GTA commercial properties that have changed hands. Mortgage maturities have the potential to put pressure on commercial property owners and their lenders – although interest rates are likely lower now than when the mortgages were taken out.

During the pandemic, government regulators have backed off on reserve requirements associated with impaired mortgage loans to allow financial institutions to provide borrowers with some accommodations without having an impact on the financial institutions’ capital-reserve requirements. If and when that level of regulatory accommodation changes, it has the potential to create considerable stress on lenders as well as borrowers.

Non-financial institution lenders are more likely to have provided mortgages on properties that don’t currently have income, such as developments under construction or land sites. Under the circumstances, defaults could be expected to come in this segment – although loans tend to be smaller than for larger, established commercial properties. Significant defaults are unlikely – some borrowers who are “out of their league” (i.e. operating at maximum financial capacity or beyond) can’t afford the financial bump in the road and may take a hit, but the market is still very buoyant with lots of capital, and most assets would likely be sold before they become distressed.

For the time being, what hasn’t changed is that abundant capital (especially from private sources) which is continuing to chase real estate – all asset types, and not just distressed assets that have been negatively impacted by COVID-19. While distressed-asset sales remain in check thus far, the ongoing pandemic could result in a rise in such transactions in 2021 and 2022. This is something we will monitor as the situation continues to evolve.

Bill Argeropoulos is an Avison Young Principal and the firm’s Canadian Research Practice Leader. He is based in the company’s global headquarters in Toronto.

-

World Economic Forum, Davos 2024: Key Insights for the Commercial Real Estate Industry 31-Jan-2024 2:36:00 PM

World Economic Forum, Davos 2024: Key Insights for the Commercial Real Estate Industry 31-Jan-2024 2:36:00 PM -

Opportunities arise in a downturn for North Carolina tenants and beyond 27-Mar-2020 9:41:00 PM

Opportunities arise in a downturn for North Carolina tenants and beyond 27-Mar-2020 9:41:00 PM -

Avison Young completes acquisition of U.K.-based GVA; two companies combine under Avison Young name and brand 8-Feb-2019 11:12:00 PM

Avison Young completes acquisition of U.K.-based GVA; two companies combine under Avison Young name and brand 8-Feb-2019 11:12:00 PM -

Toronto – A Development Retrospective 28-Feb-2019 11:16:00 PM

Toronto – A Development Retrospective 28-Feb-2019 11:16:00 PM -

Fourth Annual Apartment Renter Survey Results 18-Nov-2019 8:55:00 PM

Fourth Annual Apartment Renter Survey Results 18-Nov-2019 8:55:00 PM -

Distressed assets? Not yet… 16-Feb-2021 1:30:00 PM

Distressed assets? Not yet… 16-Feb-2021 1:30:00 PM