How ESG factors and material sector trends are impacting the state of the global industrial supply chain

As industrial supply chain complications continue, the future of global exports-at-large remains uncertain.

Could a focus on ESG (environmental, social and governance factors) and trends across materials sectors hold the answers to the best path forward?

Shifts in where suppliers manufacture is not all that’s under consideration as organizations take a moment to reassess supply chain prospects and think about the best long-term strategies.

ESG represents a fundamental change in how businesses operate and are assessed, and the key to strong success with ESG could lie in increased supply chain transparency and responsible sourcing.

Supply chains, in our view, are the foundation on which businesses are built, said Lee Sellenraad, Avison Young Director of North American Consulting Group, “CEOs across the world are now cognizant that ESG goals need to be embedded into their overall supply chain strategy if they are going to succeed in their ESG efforts.”

In fact, studies from McKinsey have estimated that up to 90% of a company’s sustainability impacts originate in its supply chain.

“Companies are now focusing on monitoring ESG performance and ensuring compliance to sustainability standards, not only within their organization, but across their complete supply chain,” said Jeff Estep, Avison Young Principal, Strategy and Operations Consulting, “Increasing transparency is fundamental to making supply chains resilient, as it breaks down silos, connects all parties, facilitates real-time data sharing, and equips business leaders with predictive insights.”

This call has put responsible sourcing at the top of C-suite agendas, with an increasing number of large companies pledging to only work with suppliers that adhere to social and environmental standards.

With systems that could be quite complex how can companies stay on top of their supply chains and make them more traceable, transparent, sustainable, and efficient?

Blockchain and other technologies are gaining in popularity as businesses look for ways to build resilient systems, leveraging data, analytics, and accountability to their business benefit. Information is the key to success and noting insights in real-time will be key toward both energy efficiencies, and identification of any blind spots or hinderances that could take away from sustainability objectives.

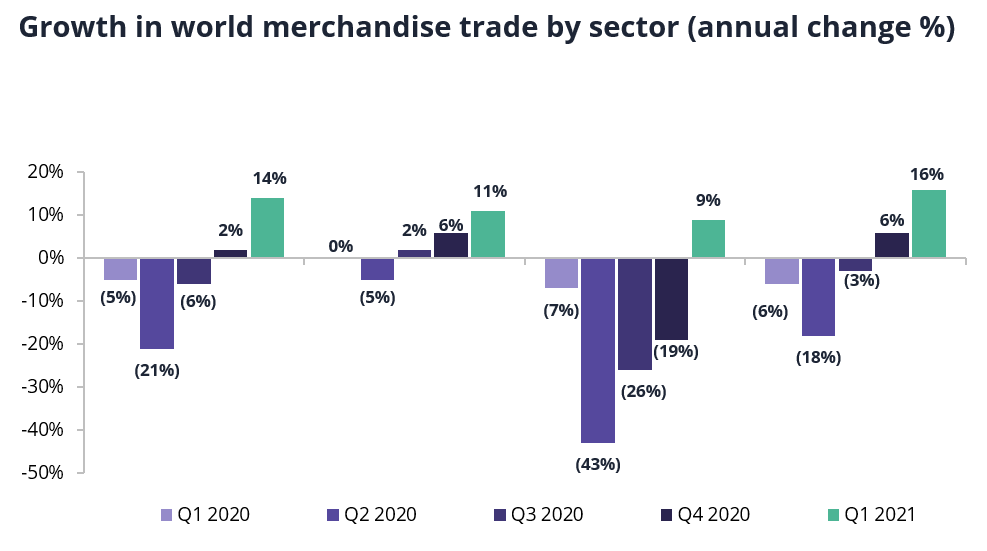

As supply chains make plans to shift tactics for the future, the current state of trades is not all poor prospects and calls for change. Even through challenges, sectors like fuels and technology are thriving, contributing significantly to global merchandise trade numbers. Could others start to bounce back soon?

Source: Broker notes, Factiva, Bloomberg, Reuters, Forbes, AT Kearney

- Most categories of manufactured goods saw significant gains in the second half of 2020, driven by textiles, pharmaceuticals, computers, and telecommunications equipment product supplies.

- A sharp 43% decline in fuels and mining products trades in Q2 2020 and the partial recovery since then reflects declining prices and supply constraints in those industries.

Insight into these materials upticks could give suppliers a window into what success could look like across industries for the near term as they continue to consider the best paths to optimize for the future.

Key Takeaways

- Companies are prioritizing ESG factors and the secret to success could lie in the sustainability of their supply chain.

- Advancements in technology can help improve transparency and ability to know which moves will be most beneficial across the entirety of a company’s supply chain.

- Markets that are performing well right now – like fuels and technology – could hold answers to improved performance potential across other economies.