Commercial real estate news releases from Avison Young

Quarterly and topical research insights to help your business gain competitive edge in commercial real estate.

The search for strong yield in last mile facilities

As buyers continue to try to put funds to work in the broader industrial property segment, what were once small property segments for niche buyers (last mile, transload, trailer storage, freezer/cooler, etc), have grown in popularity with a broad base of industrial property investors. Due to the lack of traditional industrial assets to purchase, these niche assets are attractive because they often have solid investment fundamentals. What were once small property segments for niche buyers (last mile, transload, trailer storage, freezer/cooler, etc), have grown in popularity with a broad base of industrial property investors because of the lack of traditional industrial assets to purchase.

Best,

Erik Foster

Principal

Head of Industrial Capital Markets

[email protected]

+ 312.273.9486

Quick delivery locations top investors' wish lists

Last mile warehouses and fulfillment centers have become the hot ticket in today's industrial sector, as investors rush to find properties that can support the demand for quick e-commerce delivery to growing population centers. The pandemic did structurally alter consumer buying behavior, and advanced it several years, as more people have adopted frequent online spending for many items, including fast-moving consumer goods. These close-in urban locations are important logistics stops and can make or break retailers' chances of competing and expanding their footprints in today's market. As such, they have caught the attention of many looking for strong long-term growth and cash flows.

A 2022 Wealth Management Real Estate market survey found that 52% of respondents noted last-mile warehouses as the most coveted segment of the industrial market. This is a shift from the previous four years of the survey, when more traditional locations were favored.

A key reason for the focus on last-mile facilities is the desire to secure value-add properties and reposition them for future growth. This sentiment fits with market activity, as investors turn to older, sometimes obsolete warehouses due to the prospects for rent appreciation in those people-dense areas. In some cases, rising interest rates have also made this type of strategy more profitable than buying newer, stabilized properties.

Depending on the location, last-mile or “last-touch” facilities, as coined by Prologis, can garner rents that are 20% to 50% higher than warehouses and distribution centers in traditional locations. Even with the expense of facility upgrades such as expanded parking, security and speed loading or unloading operations, these buildings can produce stronger returns. The flip side is that some developers are tearing down older buildings and adding modern facilities to meet demand. In many cases, these older sites are sold in off-market transactions, as long-time owner/occupiers are enticed to monetize their assets and make way for the new retail environment.

Avison Young's 5-year review

Over the past five years, the demand for these types of facilities has skyrocketed in many markets. While the "last mile" terminology does not always accurately define the location, these facilities represent a critical touch point -- sometimes called the aforementioned "last touch" -- for supporting consumer demand.

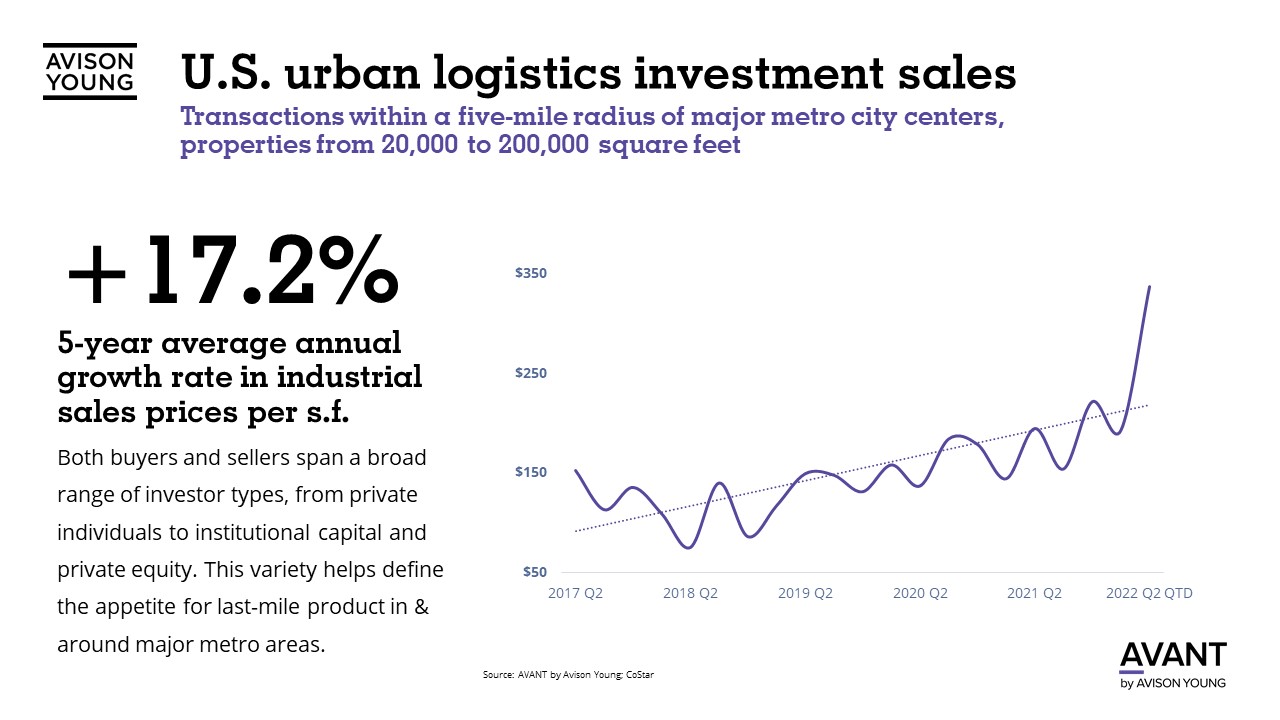

For this newsletter, Avison Young analyzed industrial data for 20 urban markets across the United States, looking at facilities ranging from 20,000 sf to 200,000 sf that are within five miles from a major city center and are likely being utilized to support those final urban delivery options. The data provides interesting insights into capital markets activity and showed the enhanced value realized in these urban logistics markets.

Among the key findings is that the average prices per square foot have steadily increased by a compounded annualized growth rate of 17.2%, increasing from just over $150 in 2017 to instances of over $300 in 2022. Given the diverse range of properties used for urban logistics, there are not often a large set of sample transactions, even in large U.S. industrial markets. And, there can be volatility inherent in the data. To help create an accurate picture, we removed properties purchased for land or redevelopment or, as is the case in some Los Angeles infill communities, for use as studio spaces or other ancillary operations.

These logistics properties also lack homogeneity, carry a number of different physical attributes and will span decades in terms of vintage, from secured lots to multi-level warehouse access. They can range from a newly constructed 200,000-sf building to a 50,000-sf former light manufacturing space built in the 1970s.

A look at sales and pricing

In our sample set, there were only an average of 50-60 urban industrial investment sales per quarter, across at least twelve U.S. markets and ranging from Los Angeles to Boston, Chicago and Atlanta. Those properties were roughly 53,000 square feet in total size – as buyers continue to scour the market for the right opportunities and leverage off-market connections to meet yield requirements.

The capital markets variables

Last mile locations may require additional capital investment -- for land, construction, inventory and labor. Some analysts estimate that each additional warehouse requires a 30% increase in inventory, as well as additional costs to move goods from the supplier to the urban warehouse and store it before sending it off to an end customer. There also are additional labor costs for receiving and storing goods in these areas.

Those added costs are considered necessary expenses by many businesses, however. By adding fulfillment centers in strategic locations that support quick shipping delivery needs, businesses can more easily and efficiently expand into new geographic markets, meet consumer shipping time demands and increase their market share. Also, major delivery services, such as FedEx and UPS, are investing significant capital to expand their delivery networks ahead of what is expected to be another record year for holiday sales.

While frenetic post-pandemic e-commerce activity is expected to naturally moderate over the course of 2022, edging down from the robust volume seen in the early days of COVID-19, last mile delivery is seen as the notable outlier. Sales of small- to mid-sized older facilities near urban consumer growth markets could keep investment pricing at higher levels due to the strong demand, lack of space -- and potential as a hedge against inflation.

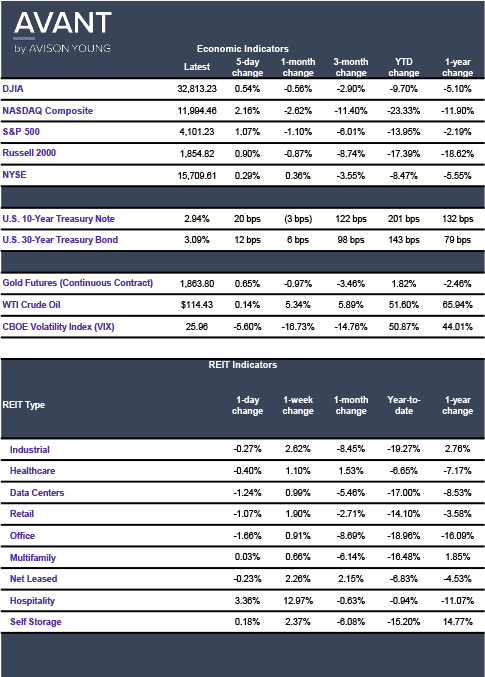

Click the image for Economic Indicators

Sources: Avison Young, Bloomberg, Supply Chain and Demand Executive, Wealth Management Real Estate