Can Toronto’s office market flatten the “sublease curve”?

As the Greater Toronto Area (GTA) office market continues to find its way through the COVID-19 pandemic, tenants are evaluating their office space needs (both short-term and long-term) as many office workers continue to work from home (WFH) and many organizations are opting to list office space for sublease as part of their strategies.

Subleasing is an opportunity for organizations looking to right-size their premises and can be a win-win situation for all parties involved. Sublandlords can adjust their premises and rental costs to their current needs, while subtenants can achieve flexibility of term as well as savings on capital expenditures. Meanwhile, the head landlord is able to maintain its cash flow and avoid carrying vacancy in its building.

In the initial phase of the pandemic in the GTA, very few spaces were put on the sublease market due to the logistical difficulties (such as touring spaces) presented by the lockdown and the reluctance of potential subtenants to transact amid the uncertain circumstances. As restrictions were lifted, however, more listings began to be marketed starting in May – as we anticipated, the curve representing the amount of office space available for sublease in the GTA began to rise rapidly as listings flooded the market.

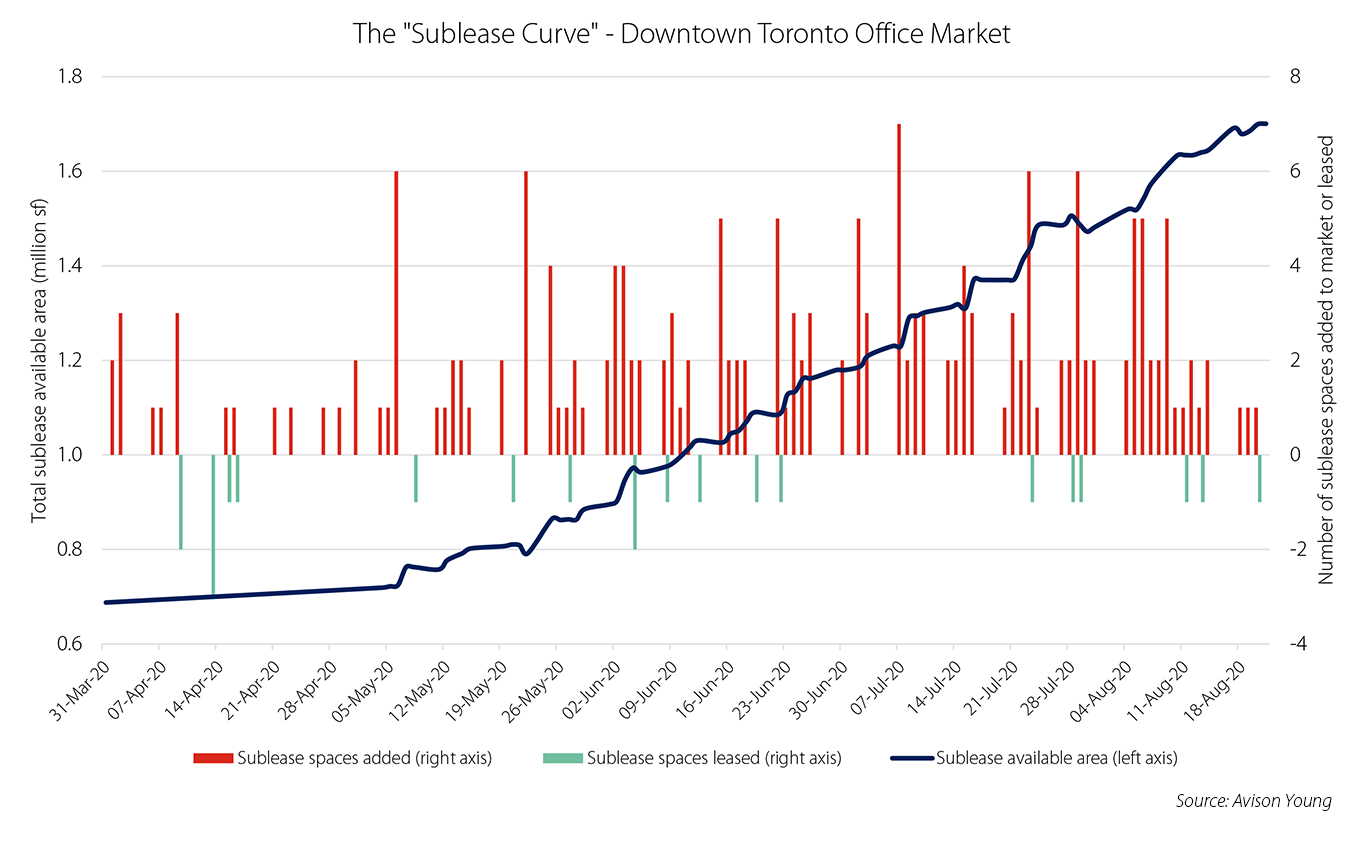

What everyone is wondering is whether demand for these spaces will be sufficient to “flatten the curve”. For now, demand remains low and sporadic, with few spaces being leased and pricing yet to be clarified by numerical evidence. The following charts illustrate the rising availability of sublease space in the GTA and Toronto Downtown office markets, along with the number of sublease spaces added to the market and leased each day.

GTA Office Sublease Market Highlights:

- From 1.2% at year-end 2019, the GTA overall sublease availability rate rose to 1.3% in Q1 2020, 1.6% in Q2 2020 and was up to 2% as of August 21st. This represents an increase of more than 1.4 million square feet (msf) in available sublease space on the market during 2020

- The total square footage of subleases on the market is more than 3.7 msf – the highest in 10 years, but still below the all-time high of 4.3 msf recorded in 2003

- As a percentage of total available space, sublease space represented 20% as of August 21st – up from 14% at the end of last year, and higher than at any time in the past decade. However, this level is approaching the peaks recorded in 2001 (23%) and 2009 (22%) during the dot-com crash and financial crisis, respectively

- If the trend continues at the average rate seen since the beginning of May, an additional 1.5 msf of sublease space could be brought to market across the GTA by year-end 2020

The greatest concentration of sublease space in the market as we head toward the end of August is in Toronto’s Downtown. Although it is still one of the tightest downtown office markets in North America, the amount of available space has increased sharply as a result of COVID-19.

- From 0.8% at year-end 2019, the Toronto Downtown sublease availability rate rose to 0.9% in Q1 2020, 1.5% in Q2 2020 and was up to 2.2% as of August 21st. This represents an increase of more than 1 msf in available sublease space on the market during 2020

- The total square footage of subleases on the market is at an all-time high of 1.7 msf – greater than the level recorded in the years following the dot-com crash of 2000 (1.4 msf) or the financial crisis of 2008 (1.2 msf)

- As a percentage of total available space, sublease space represented 32% as of August 21st – up from 20% at the end of last year, and higher than at any time in the past 20 years

- During the first three months of 2020, 77 spaces totaling just under 400,000 sf were added to the market. Under the lockdown in April, only 16 spaces totaling 80,000 sf were added. As the re-opening gathered steam in the subsequent three months (May to July), 144 spaces totaling nearly 1.1 msf were brought to market, with each month busier than the one before

- In the first three weeks of August, 31 spaces totaling 226,000 square feet (sf) were added – behind July’s pace (61 spaces / 498,000 sf) – but the month isn’t over yet

- If the trend continues at the average rate seen since the beginning of May, an additional 1.3 msf of sublease space could be brought to market in downtown Toronto by year-end 2020

Although most sublease spaces added to the market so far have been relatively small (5,000 sf or less), some larger spaces – including blocks of more than one floor – are beginning to be listed and, as large organizations continue to evaluate the success of their WFH strategies, there is the potential for many more to come.

Length of term is always an important consideration with respect to subleasing space. Historically, a longer remaining term has been a competitive advantage when marketing a sublease, but the current climate of uncertainty has turned that notion on its head somewhat. Tenants looking to do new deals or renewals at the moment may be reluctant to commit to longer terms, making shorter-term subleases more appealing than direct space – unless building landlords also show a willingness to do short-term direct deals to attract and retain tenants.

In many cases, sublease space has been a harbinger of downward pressure on rental rates in markets where it is abundant as it has the capacity to compete with direct space. Bearing in mind that every deal is different, presently, the lack of leasing velocity means that this effect has not yet been observed in what has been a landlords’ market – especially downtown. Anecdotally, the few sublease deals that have been inked have still been able to achieve full rent recovery.

Nevertheless, it’s difficult to imagine that this situation will be sustainable given the potential of available sublease space to increase further. In August, Oxford Properties unveiled its “Comeback Bonus Commission” program in Toronto’s downtown market, which will pay brokers an additional $1.00 per square foot (psf) as a bonus fee for a total of $2.20 psf in commission. This move is aimed not only at generating tours in Oxford’s portfolio, but perhaps also at incentivizing the brokerage community in order to compete effectively with a growing sublease market.

Looking ahead, there are still more questions than answers for observers and stakeholders in the GTA office market. Will there be enough demand to absorb the influx of sublease space as confidence returns and potential subtenants take advantage of the opportunity for short-term deals in these uncertain times? Or will the supply of available space continue to grow, with little demand to stem the tide? Will some head landlords be willing to take back sublease spaces to accommodate existing tenants looking to expand, or to create larger blocks of space to compete against new developments in what is still a relatively tight market?

Bill Argeropoulos is an Avison Young Principal and the firm’s Canadian Research Practice Leader. He is based in the company’s global headquarters in Toronto.

The spread of COVID-19 and the containment policies being introduced are changing rapidly. While information in the briefing notes is current as of the date written, the views expressed herein are subject to change and may not reflect the latest opinion of Avison Young. Like all of you, Avison Young relies on government and related sources for information on the COVID-19 outbreak. We have provided links to some of these sources, which provide regularly updated information on the COVID-19 outbreak. The content provided herein is not intended as investment, tax, financial or legal advice and should not be relied on as such.